MOST IMPORTANT ACCOUNTING TRENDS AND FORECASTS FOR 2020 AND BEYOND

From transforming systems and processes of modern day accounting to converting manual tasks into automated functions, the word technology in itself is synonymous to development in today's business landscape. It has allowed businesses to operate more efficiently and effectively.

Along with on-premise solutions, developments like SaaS saw the industry add cloud-based subscriptions and that doesn't stop there. In this article we will be presenting the top accounting trends in the course of 2020 and beyond that are most likely to happen because of technological disruptions.

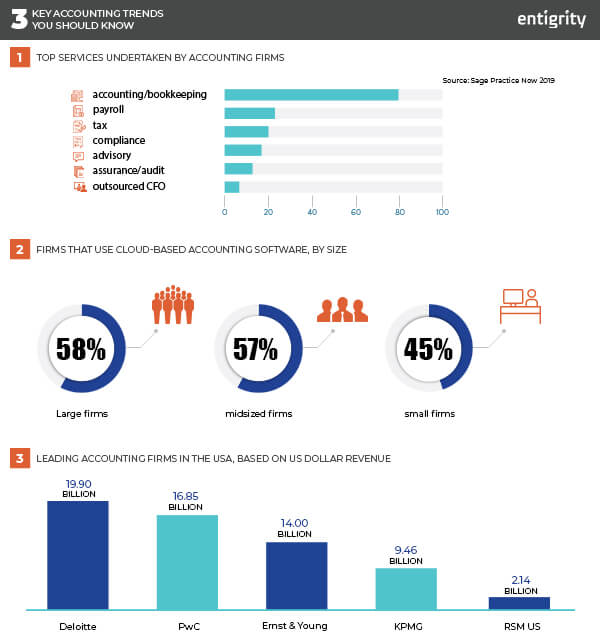

3 central trends that mainly drive accounting practice

- Top services undertaken by firms

- Firm types and their utility of accounting software

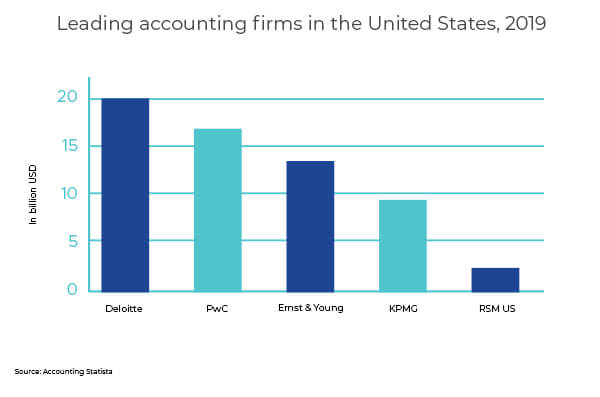

- Leading accounting firms of the USA

The organizations need to review themselves depending on the recent developments in the accounting industry so that they could sustain the disruptions. The future trends will reflect them to the aspiring professionals so that they may adopt the measures. Here's a more comprehensive discussion:

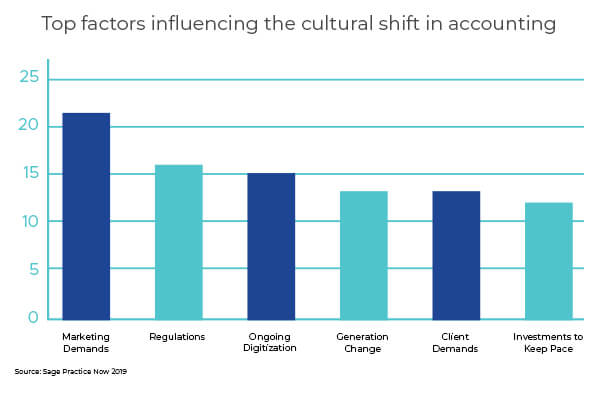

As we begin, we need to list out the top factors that influence the cultural shift in accounting.

1. Automated processes for Accounting

The most notable shift happening in the industry revolves around automation. It eliminates confusion, minimizes errors and that's why companies invest in having automated solutions. Even ACCA study suggests that more than half of the C-level executives in the accounting industry expect the development of automated accounting systems. In the coming years, it will have the highest impact across several industries, allowing accountants to utilize data and optimize processes for both the best accounting software for small businesses and large enterprises.

At the same time, since automation heavily depends on computers the businesses face the risk of security compromised. This has also led to an increasing demand for internal auditors to check for inaccuracies. That comes as a relief to in-house accounting services that they won't be replaced by bots anytime soon.

2. Accounting Software Taking Over

It has only grown intense recently and the competition will grow even fierce in the coming years. User friendly functions and more features will be the key but creating robust solutions will sit at the top for all the accounting software companies. At the same time, one can't overlook the fact that the prime purpose of the software is to optimize processes and minimizing manual tasks.

The market will experience a higher level of growth for sure. In fact, Fortune Business insights suggest that during 2019 to 2024, the market will grow at a CAGR of 8.5%, with North America seen at the forefront. The adoption of modern technologies in the Asia Pacific will also drive the growth of accounting software companies.

Most Popular Accounting Software

Sage Intacct. A useful accounting solutions for functions for cash management, accounts payables and receivables and spend management.

Xero. It eases tracking and editing transactions, monitor billing and invoicing, and even process payroll.

FreeAgent. FreeAgent lets you send and track invoices and manage expenses. Its built-in stopwatch also helps in keeping time records.

Gusto. Gusto comes with capabilities for automated payroll management to ensure the elimination of human errors.

Sage. Business Cloud Accounting. This software combines accounting, expense management, and compliance management into one platform.

3. Accounting Functions Outsourcing

Outsourcing accounting functions is becoming a popular strategy among many companies. It is one of the fastest-growing areas in the accounting industry because it's largely seen as a viable way to increase profitability by saving employment costs like payroll, taxation, salaries, benefits and training expenses. That is the main reason why there has been an enormous rise in companies providing outsourced accounting service.

Every year, businesses experience satisfaction in their outsourced accounting value and results. Outsourcing is now an increasingly important method for CPA firms to deliver efficient services to their clients, as well as analyze business operations and add more value to their business. It is also becoming a highly esteemed career choice all over the world.

4. Cloud-Based Accounting Software

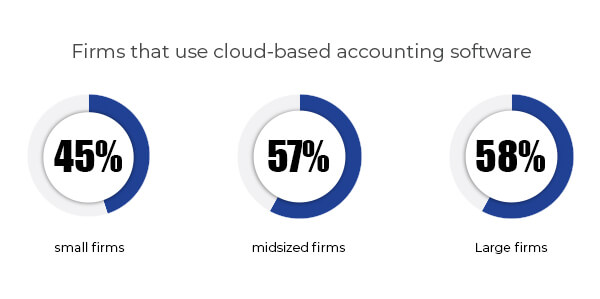

Cloud-based accounting systems enables firms access their system anytime anywhere, hence, it's becoming a popular place to store and process files for accounting services. Data access also includes tracking inventory, sales, and expenses. It also helps in creation of workflows, saving businesses valuable time. Having such benefits are driving businesses to make the shift to cloud-based accounting systems.

Over 67% of accountants now believe that cloud technology has made their work easier. A Sage survey indicates that 53% of the firms adopted cloud-based solutions for project management and client communication. Among various industries is the accounting industry, which is taking a major leap for more effective and comprehensive financial reporting and analytics and making a move towards cloud based accounting software.

5. Data Analytics

The accounting industry is also shifting its focus to data analytics since it eases a number of specific accounting tasks. As accountants are taking on new roles as advisors, analyzing numbers helps them develop unique skill sets to obtain valuable insights and identify process improvements. It also helps increase efficiency and manage risks better.

Although analytics as part of accounting services is not entirely new, it is now more powerful, presenting financial performance in a new light for better actionable insights. Larger accounting firms apply data analytics in tax, consulting, risk management, and auditing. Meanwhile, CPAs in other organizations are utilizing the capabilities of the best data analytics solutions to support industry-specific needs.

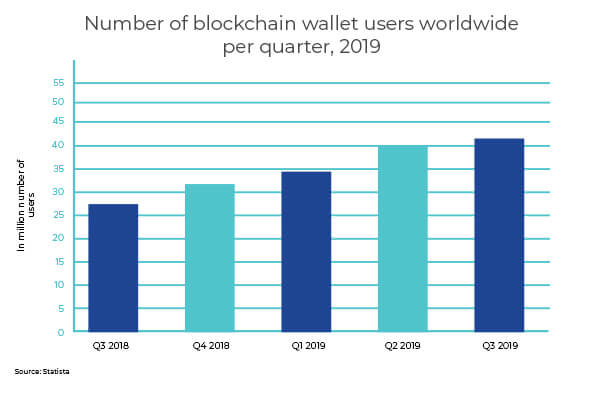

6. Blockchain

Blockchain-based projects saw exponential growth over the past few years, acquiring $1 billion in investment. It is already changing the accounting sector by lowering the costs of reconciling and maintaining ledgers. It helps the accountants gain a more unobstructed view of their organization’s obligations and available resources.

The Big Four in the accounting industry have joined the blockchain trend by having people work in distributed ledger laboratories. This is in the hopes that immutable distributed ledgers will become a reality. In that case, their audit and accounting divisions will most likely become obsolete. The accounting industry needs to understand blockchain technology more and for good reasons. Blockchain It also provides the needed accuracy in terms of ownership and history of assets.

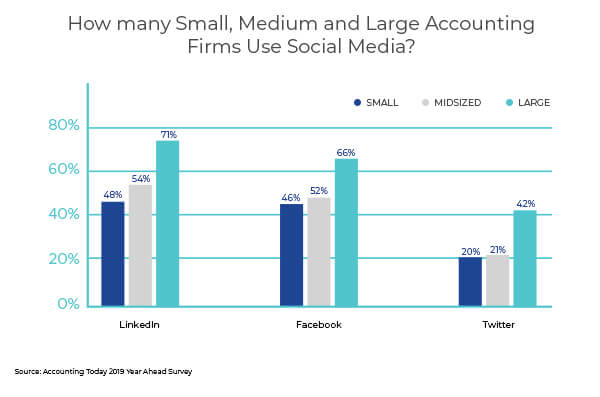

7. Leveraging Social Media

The use of social media for accountants is quickly becoming a powerful branding and sales tool that boosts their exposure. About 77% of accountants use social media as part of their marketing and branding strategy. It is also strongly recommended to enhance their skills or expertise in social media which in turn provides many opportunities to learn more about the industry.

An effective social media strategy can contribute to the profitability of a business. Social media sites like Facebook, Twitter, LinkedIn, blogs, and community forums help businesses keep in touch with clients. Accounting firms also benefit from monitoring competitors and industry trends. This figure is sure to grow in the coming years, as social media platforms help businesses establish reputable images.

8. Advisory Services

Services like growth profitability and strategies, as well as business intelligence, are becoming better and are growing in numbers. The discovery of new solutions for analytics will combine accounting technology and financial advisor input in the near future. This is also being predicted by experts. Accountants will be able to focus more on decoding data for deeper insights. The increasing introduction of more advanced technologies in the accounting industry allows accounting firms to focus on the quality of their advisory services.

The elimination of manual and repetitive tasks opens opportunities for accounting firms to spend more time analyzing data, providing insights, and giving advice to their clients. Unlike other tasks in accounting processes, decision-making will always fall into the hands of human professionals and experts. Hence, complete automation in the accounting sector cannot be possible.

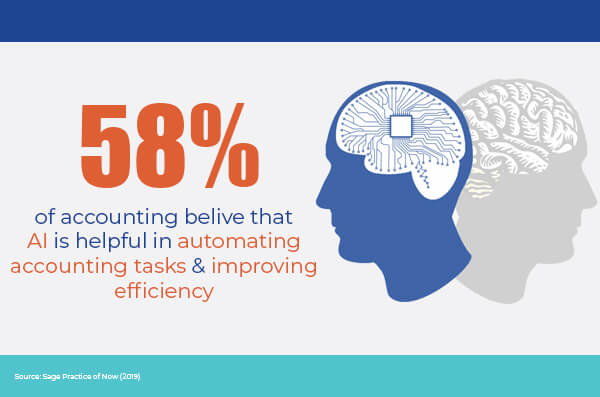

9. Artificial Intelligence

AI is producing positive results in the accounting industry analyzing large volumes of data at high speed, as well as increasing productivity and generating more accurate data at a reduced cost. The Sage Practice of Nov 2019 report reveals that about 66% of accountants would invest in AI. Also, 55% of them see themselves using AI by 2024.

The importance of AI in accounting is growing more steadily as it optimizes administrative tasks and accounting processes that result in various structural changes. AI provides vast opportunities for accountants and a new level of efficiency for workflows. These figures only show that AI is transforming the industry. However, experts do not see AI replacing human roles. Instead, AI will be assisting human decision-making and empowering lucrative and in-depth analyses.

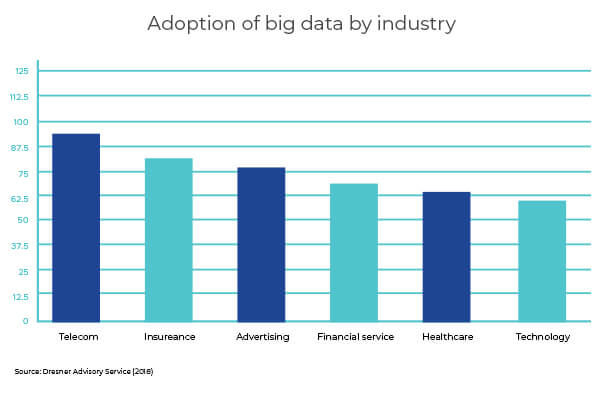

10. Big Data

With the use of big data, accountants and experts transform key internal data sets into secure, vigorous, and important data analyses. It fills the same significant role in the accounting industry by supporting companies and firms through expanded assessment methods, with accountants and finance experts working behind the scenes. A growing number of firms are now prioritizing accountants who have extensive knowledge in analytics and data science. This shows that the accounting industry is shifting from its reactive nature to becoming more proactive.

This makes it crucial to understand what big data is in making business decisions. This shows that the accounting industry is shifting from its reactive nature to becoming more proactive. CPAs, backed by big data, can now focus more on planning, taking control, analyzing processes, and anticipating problems before they even happen.

11. Offshore Staffing and Setting Up Remote Work

Employers these days are having a hard time finding top talents in finance and accounting. In a recent report from the US Bureau of Labor Statistics (BLS) on Unemployment Rates by Occupation, it is revealed that the accountant unemployment rate is at 2.0%. This is why it is more important for them to broaden candidate search and hiring requirements. According to a 2018 survey published by Convergence Coaching, about 43% of CPA firms are offering their employees the chance to work from home on a regular

Accounting leaders are consequently adapting to the trend of allowing employees to engage in remote work. In fact, candidates get to dictate certain terms of their employment, among which is having a flexible and remote work setting. basis. This would not have been possible in the past. So, with technological advancements and the emergence of computerized accounting systems, accountants working from home are able to produce excellent results in their work as those in office settings.

Current accounting trends tell us one thing: digitization and remote working are now norms in the industry and that's the way how accounting firms are going into the future. Other than these trends, however, reducing costs is one of the significant benefits that companies and accounting firms experience as they embrace the latest technologies to optimize processes.

If you are looking to ease your workload and cut enormous cost on hiring experienced efficient staff, it's high time you considered hiring offshore staff. Going ahead with offshore staff can be a stepping stone in finding a high growth trajectory for your firm.

Entigrity™ is a trusted offshore staffing partner to 725+ accountants, CPAs, and tax firms across the US, UK, and Canada. Our flexible and transparent hiring model gives helps firms of all sizes to hire staff for accounting, bookkeeping, tax preparation, or any other task for 75% less cost. As a firm 'run by accountants, for the accountants,' Entigrity captures the hiring needs of accounting firms most precisely, providing staff that works directly under your control and management; still, you are left with the least to worry about compliance, payroll taxes, overheads or any other benefits. To offshore accounting services, bookkeeping, Tax, and audit services, visit us.